A segregation of duties is where no individual person working for a business has sole ownership/control over the lifespan of a transaction. This means in an ideal world there should be a minimum of two separate sets of eyes on each transaction.

Transactions go through various steps which theoretically should be assigned to different people however some smaller businesses may not have the staff to cover all of these steps and would benefit the use of external bookkeeping or accounting services. The various steps in an individual transaction are:

- Initiating the transaction

- Approving the transaction

- Recording the transaction

- Reconciling the transaction

- Handling the asset the transaction related to (eg: Bank Accounts)

- Reviewing and signing off on the Financial Reports and Statutory Obligations

The segregation of duties is the assignment of various steps in the process to different people. The intent behind doing so is to eliminate instances in which someone could engage in theft or other fraudulent activities by having an excessive amount of control over a process.

The primary reason for businesses to implement adequate segregation of duties is to minimise the potential for fraudulent activities from occurring within the business accounts but may also increase data integrity by minimising errors which may arise from duplicate transactions. However, these errors from duplication may only have a minimal impact on the accuracy of the financial statements of a business.

Financial fraud happens when an individual or group of people uses misleading, deceptive, or other illegal practices to deprive a business of capital, assets money which may negatively impact the financial health of the business.

While there are many different types of fraud there four main types that can impact a business from an internal perspective:

- Larceny/Embezzlement – is the most common type of fraud that happens to small and medium businesses and is where a person who is in control of a businesses funds or other assets illegally uses these funds or assets for their own personal gain.

- Internal Theft – is where staff/employees that take assets that are intended for sale (Inventory) or consumables such as office supplies from the business without having the intention to financially compensate the business for these items. Another form of internal theft is where an employee purchases personal items using their company corporate card and not reimbursing the company for these items.

- Bribery/Kickbacks/Payoffs – happens when a representative or agent of a business accepts an illegal payment from a third party (eg: competitor in the market) in exchange for access to the business’s products/services or sensitive information.

- Skimming – is when an employee pockets money from receipts but doesn’t record the revenue in the books of the business.

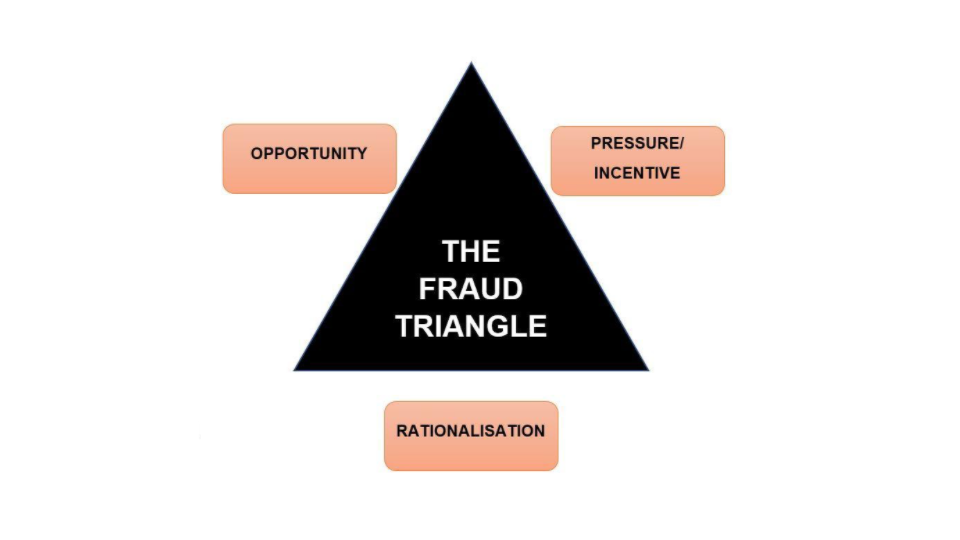

Internal Financial Fraud happens when three elements are present: Opportunity, Pressure/Incentive and Rationalisation. These three elements are known as the “Fraud Triangle”.

Pressure/Incentive – The financial need behind the act of fraud. This is usually the catalyst that motivates people to commit acts of fraud. It may be an employee that is suffering significant personal financial stresses.

Opportunity – The ability to actually commit fraud. Opportunity increases as a result of a lack or ease of managerial oversight and business procedure. The less steps it takes to commit the fraudulent act, the higher the probability it will occur.

Rationalisation – This is where the person who has committed the act of fraud tries to justify it. People who commit fraud generally see themselves as being honest and believe themselves to be victims of circumstance and develop an explanation such as needing the money for a good cause (eg: paying for a sick child’s medical bills).

As business owners do not have control over an employee’s personal finances or their mindset, the only way they can minimise the risk of internal financial fraud from occurring within their business is to focus on creating good policies and procedures that incorporate adequate segregation of duties to ensure more than one person is responsible for each transaction which is being overseen by someone in a higher management position.

There are recommended segregation of duties processes for each accounting function (Accounts Payable, Accounts Receivable, Payroll, etc) to help assist business owners minimise their internal fraud risk potential, it is recommended that business owners discuss these recommended processes with a qualified bookkeeping or accounting professional to achieve the best results for their individual business structure and circumstances.

Please note: This article is presented from a theoretical perspective only and does not replace the advice of qualified Bookkeepers, Registered BAS Agents or Registered Tax Agents.