Before computing account revolutionised accounting practices and the way businesses recorded their accounting transactions, business owners relied on 7 specialised journals and 3 primary ledgers to maintain their accounting practices. This is referred to as Manual Bookkeeping as business owners would literally have a separate book for each journal and ledger.

JOURNALS

The 7 specialised journals consist of the Purchases Journal, Purchases Returns Journal, Sales Journal, Sales Returns Journal, Cash Payments Journal, Cash Receipts Journal and the General Journal.

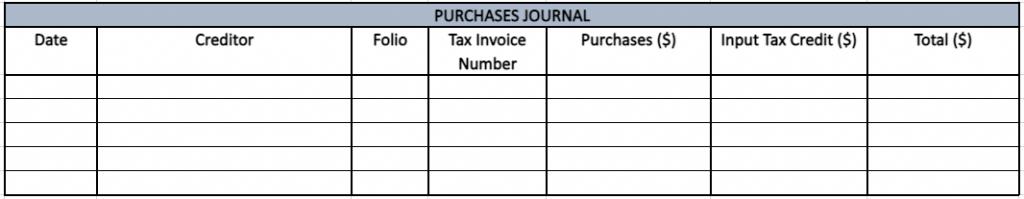

Purchases Journal

The Purchases Journal records credit purchase that has been made by the business in relation to trading stock or cost of goods sold (COGS). These purchases are displayed on a Tax Invoices issued by the supplier and the details of the supplier Tax Invoice is recorded in the Purchases Journal.

The columns of the Purchases Journal should include:

- The Date of the invoice.

- The name of the Creditor buying the goods/services on credit.

- The Folio which is the ledger account number reference when transaction is posted.

- The Tax Invoice Number.

- The Purchase Amount excluding GST.

- The Input Tax Credit being the GST element.

- The Total Amount this being the Purchase Amount plus the Input Tax Amount.

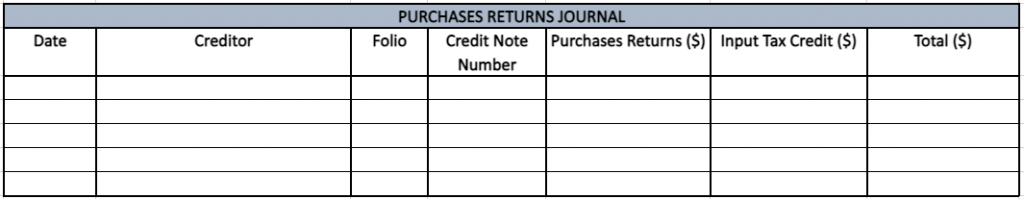

Purchases Returns Journal

When a business receives purchased stock that is damaged or a Tax invoice from a supplier that has overcharged the business for stock purchased, the supplier may issue the business with a Credit Note. The details of this Credit Note are recorded in the Purchases Returns Journal.

The columns of the Purchases Returns Journal should include:

- The Date of the Credit Note.

- The name of the Creditor issuing the Credit Note.

- The Folio which is the ledger account number reference when transaction is posted.

- The Credit Note Number.

- The Purchase Returns Amount excluding GST.

- The Input Tax Credit being the GST element.

- The Total Amount this being the Purchase Returns Amount plus the Input Tax Amount.

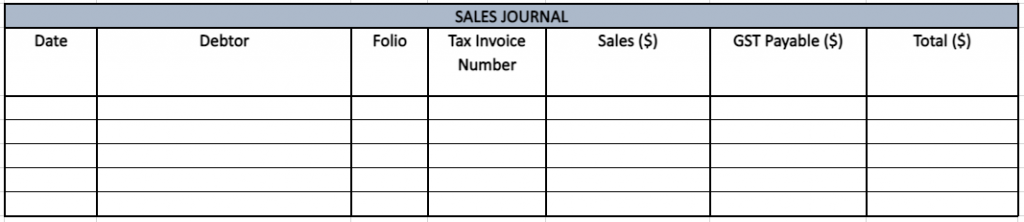

Sales Journal

When a business sells goods and services on credit to its customers and issues them with a Tax Invoice, the details of the Tax Invoice are recorded into the Sales Journal.

The columns of the Sales Journal should include:

- The Date of the invoice.

- The name of the Debtor buying the goods/services on credit.

- The Folio which is the ledger account number reference when transaction is posted.

- The Tax Invoice Number.

- The Sales Amount excluding GST.

- The GST Payables Amount

- The Total Amount this being the Sales Amount plus the GST Payable Amount.

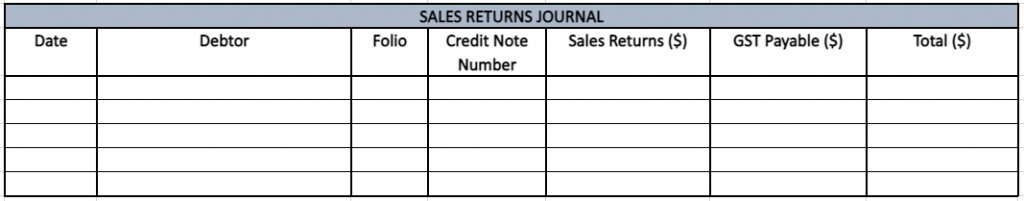

Sales Returns Journal

The Sales Returns Journal is used to record Credit Notes that have arisen due to the return of damaged goods or poor services provided. Credit Notes may also be raised in the event customers have been overcharged and require a credit adjustment to the initial sale that has already been invoiced and issued to the customer.

The columns of the Sales Returns Journal should include:

- The Date of the Credit Note.

- The name of the Debtor receiving the Credit Note.

- The Folio which is the ledger account number reference when transaction is posted.

- The Credit Note Number.

- The Sales Returns Amount excluding GST.

- The GST Payable Amount.

- The Total Amount of the Credit Note being the Sales Returns Amount plus the GST Payable Amount.

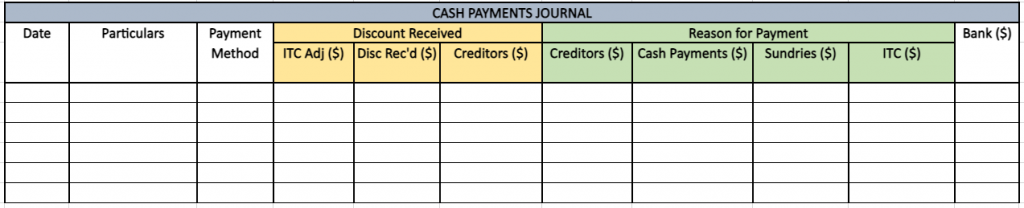

Cash Payments Journal

Payments made by a business are recorded in the Cash Payments Journal. These payments included payments made in relation to general/admin expenses such as telephone and electricity, purchases made by EFTPOS and Direct Debit, withdrawals made by the business owner, payments to creditors, and interest and bank fees.

The columns of the Cash Payments Journal should include:

- The Date of the payment.

- The Particulars of who is being paid.

- The Payment Method such as EFTPOS or Direct Debit (Historically this column was used to record Cheque numbers in chronological order as they were written and sent for payment).

From here there can be two sections if the business is entitled to discounts upon early payment.

1. Discounts Received

Under this section, the journal is broken up into 3 columns.

- Input Tax Credit Adjustment (ITC Adj) to adjust the GST element.

- The amount of the Discount Received (Disc Rec’d) excluding GST.

- The total Creditors amount being the Discount Received plus the Input Tax Credit Adjustment.

2. Reason for Payment

This section is for why the payment is being made and is broken into 4 columns.

- Payments made to Creditors in relation purchases made on credit.

- Payments made for Cash Purchases of trading stock.

- Payments made for Sundries such as donations, and asset purchases.

- The Input Tax Credit being the GST element.

The last column of the Cash Payments Journal is:

- The total amount that is reflected in the Bank upon payment.

This column is handy if your bank allows batch payments where you pay multiple suppliers using one transaction.

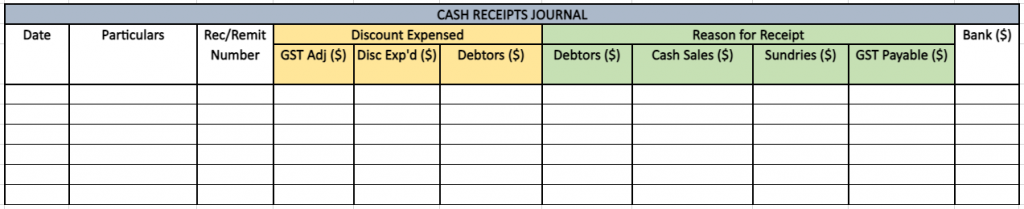

Cash Receipts Journal

When money is received by the business the details of these receipts are recorded in the Cash Receipts Journal. Historically, physical receipts were created and issued to those who made the payment to show that the payment had been received as customers would have paid their accounts via cheque and may have been sent via post. These days, payments are made electronically by the customer who sends a remittance advice for the payment made so the business can record the customer payment appropriately. Some industries that use Trust Accounts such as Real Estates and Law Firms are still required to issue receipts for payments made in relation to these Trust Accounts as they are receiving money on behalf of their clients. Other receipts recorded in the Cash Receipts Journal can be from Cash Register Rolls for Cash Sales, EFTPOS Receipts and Receipts in relation to Sundry transactions such as receiving money for the sale of an asset.

The columns of the Cash Receipts Journal should include:

- The Date of the payment.

- The Particulars of who is being paid.

- The Remittance Number or Receipt Number if the business is issuing receipts.

From here there can be two sections if the business is giving discounts upon early settlement of customer accounts.

1. Discount Received

Under this section, the journal is broken up into 3 columns.

- GST Payable Adjustment (GST Adj) to adjust the GST element.

- The amount of the Discount Expensed (Disc Exp’d) excluding GST.

- The total Debtors amount being the Discount Expensed plus the GST Payable Adjustment.

2. Reason for Receipt

This section is for why the business is being made paid money to be receipted and is broken into 4 columns.

- Payments made by Debtor in relation Sales made on credit.

- Payments received for Cash Sales such as Cash Register Rolls.

- Payments received for Sundries such as selling an asset.

- The GST Payable.

The last column of the Cash Receipts Journal is:

- The total amount that is being deposited to the Bank.

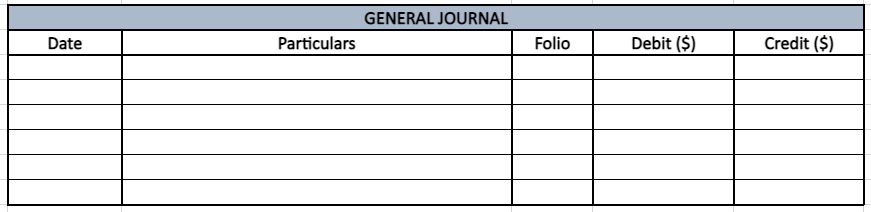

General Journal

The General Journal is different from the other journals that have already been discussed and contains separate unrelated transactions. Unlike the other journals, the General Journal focuses mainly on adjustment transactions and transaction that are not related to the general operations of the business.

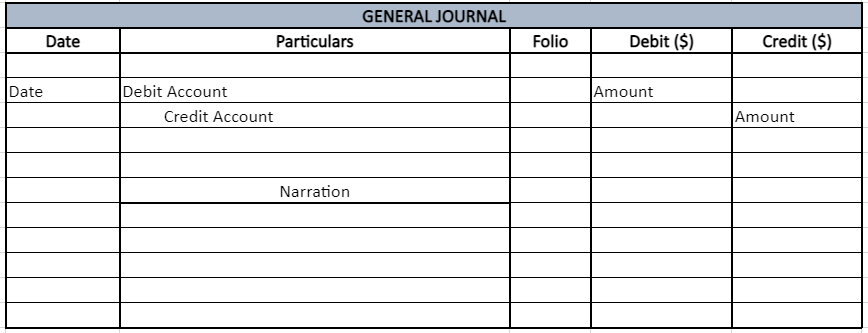

The columns of the General Journal consist of:

- The Date of the transaction.

- The Particulars of the which accounts within the chart of accounts are being used.

- The Folio being the ledger account code.

- The Debit column that records the amounts to be debited.

- The Credit column that records the amounts to be credited.

When recording transaction in the General Journal, all debit amounts must be entered before credit amounts, all entries much have a narration describing the transaction, a line must be drawn under each transaction after the narration to separate it from the next transaction to be recorded but only in the “Particulars” column and the Debit and Credit Columns should not be totalled but should balance meaning debits should equal credits.

The types of transactions that you will typically find in the General Journal are:

- Transaction related to the commencement of a business.

- Purchased of a fixed non-current asset on credit.

- Sale of a fixed non-current asset on credit.

- Correcting posting errors.

- Writing off bad debts.

- Accrued interest expenses.

- Accrued interest received.

- Withdrawal of stock/inventory.

- Withdrawal of assets by owner.

- Contra entries.

LEDGERS

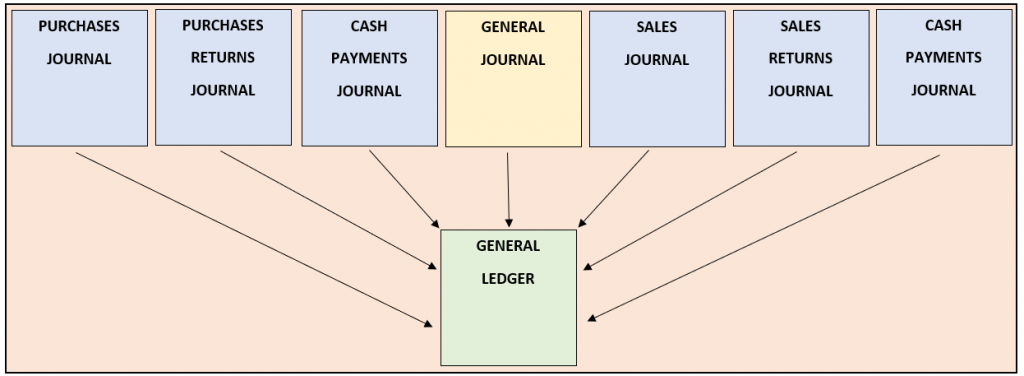

Transaction recorded in the 7 journals listed above are then “posted” to the relevant associated ledger of the 3 primary ledgers being the Accounts Payable Subsidiary Ledger, the Accounts Receivable Subsidiary Ledger and the General Ledger.

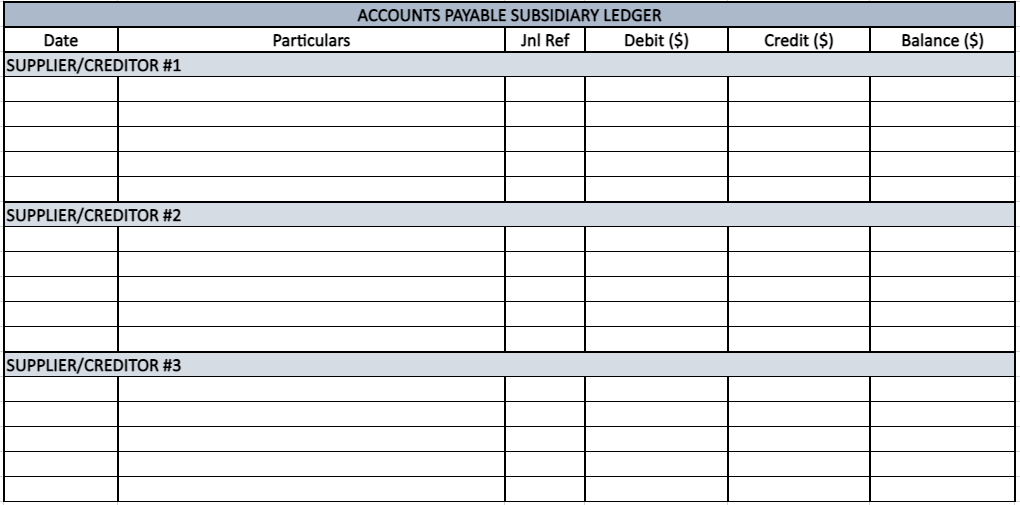

Accounts Payable Subsidiary Ledger

The Accounts Payable Subsidiary Ledger is used by a business to record and track purchases that are made on credit via the name of the Supplier/Creditor. This helps a business to keep track of purchases have been made, what purchases returns have occurred and what payments have been made in relation to the purchases. This is important to a business from a cash flow perspective as it will help give business owners a general idea of what money is owed to which Suppliers/Creditors. Not keeping these records may cause a business to not realise it has fallen behind in its payments which in turn can result in the business being put on “Stop Credit” which means the business is unable to continue to purchase from that Supplier/Creditor until the account has been paid. This may have a detrimental impact on business operations.

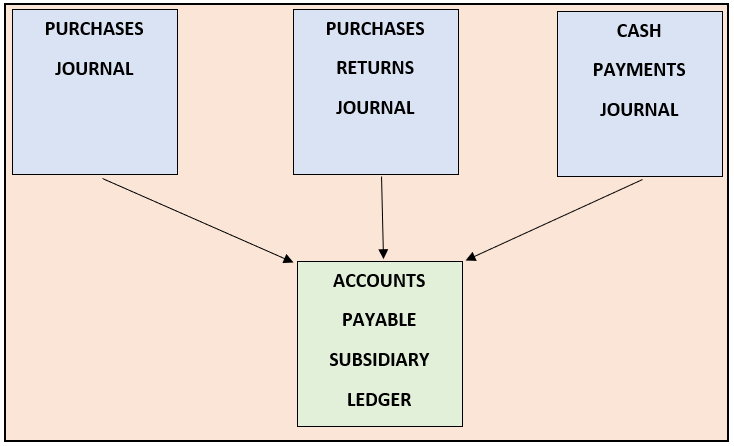

Information contained in the Accounts Payable Subsidiary Ledger uses information that is posted from the Purchases Journal, Purchases Returns Journal and the Cash Payments Journal.

The Accounts Payable Subsidiary Ledger consists of the columns:

- The Date of the transaction.

- The Particulars being whether it was a purchase, purchase return or a payment.

- The Journal Reference (Jnl Ref) being which journal was the transaction posted from (PJ, PRJ, CPJ).

- The Debit column to record the posted payments and purchases returns.

- The Credit column to record the posted purchases.

- The Balance column to track how much is owed to the Supplier/Creditor after all purchases, purchases returns, and payments have been posted.

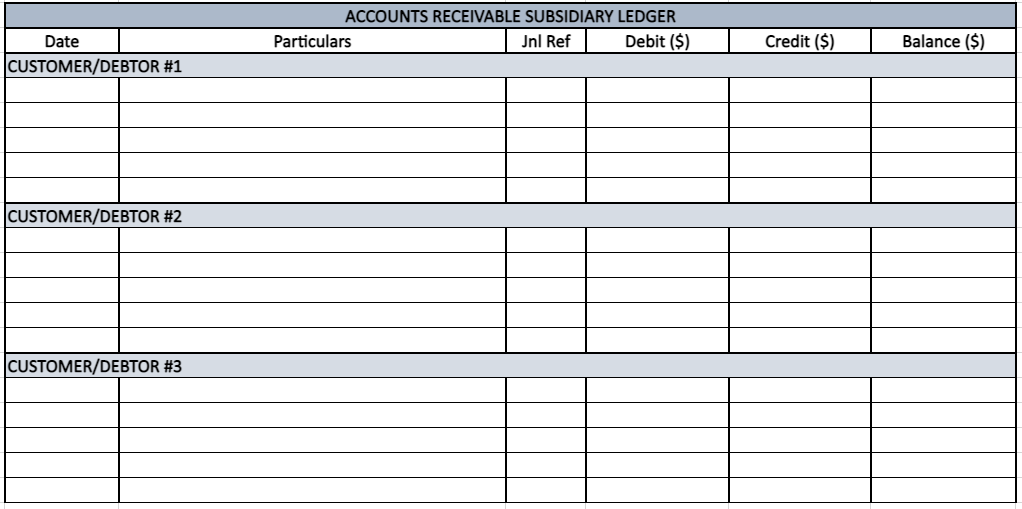

Account Receivable Subsidiary Ledger

The Accounts Receivable Subsidiary Ledger is used by a business to record and track sales that are made on credit via the name of the Customer/Debtor. This helps a business to keep track of sales that have been made, what sales returns have occurred and what payments have been received in relation to the sales. This is important to a business from a cash flow perspective as it will help give business owners a general idea of what money is owed to by Customers/Debtors. Not keeping these records may cause a business to not realise they have not received payments for sales which in turn can result in the business losing profits, having to engage in debt collection processes or writing of the sales to bad debts.

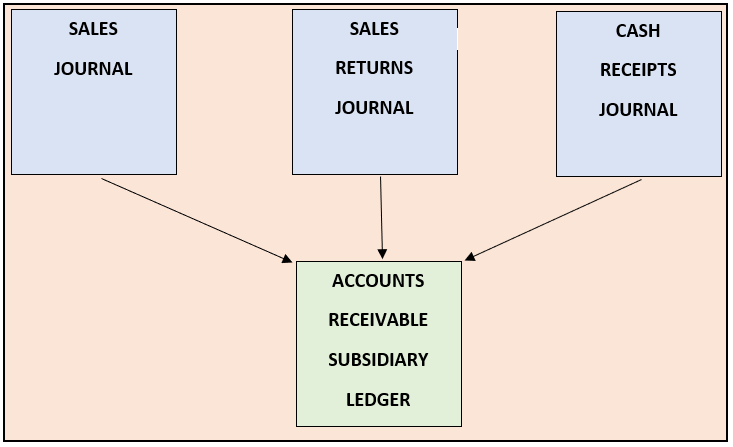

Information contained in the Accounts Receivable Subsidiary Ledger uses information that is posted from the Sales Journal, Sales Returns Journal, and the Cash Receipts Journal.

The Accounts Receivable Subsidiary Ledger consists of the columns:

- The Date of the transaction.

- The Particulars being whether it was a sale, sale return or a payment.

- The Journal Reference (Jnl Ref) being which journal was the transaction posted from (SJ, SRJ, CRJ).

- The Debit column to record the posted sales.

- The Credit column to record the posted sales returned and the payments.

- The Balance column to track how much is owed by the Customer/Debtor after all sales, sales returns and payments have been posted.

General Ledger

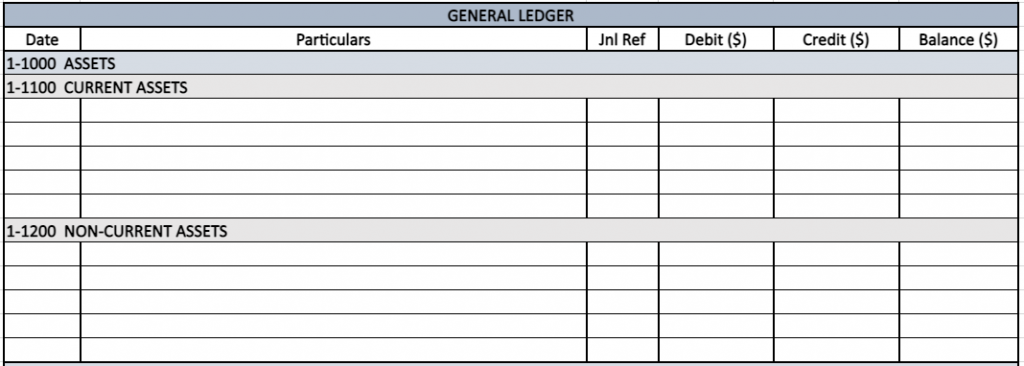

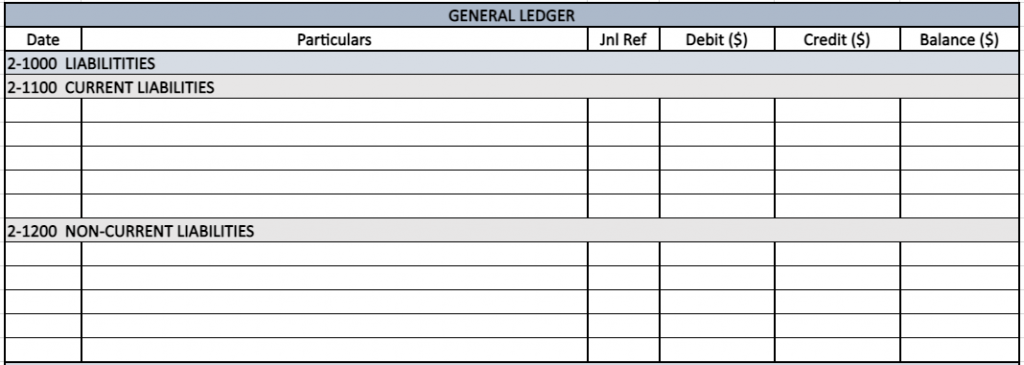

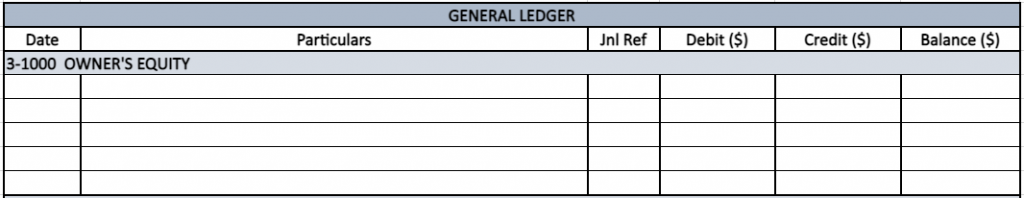

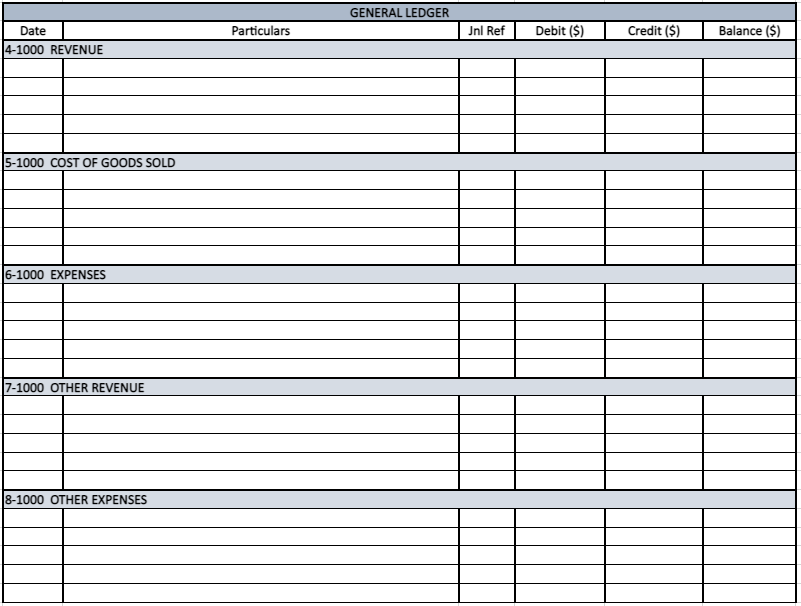

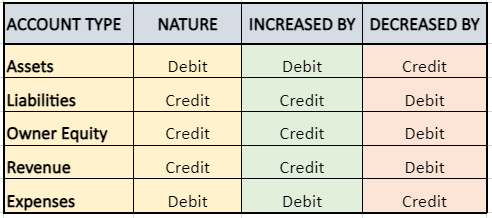

The General Ledger is a master accounting document that contains every account the business uses and tracks its movements. These accounts are split into different categories as per the chart of account – Assets, Liabilities, Owner’s Equity, Revenue and Expenses. All accounts contained in the General Ledger are numbered to coincide with the accounting category the account belongs to.

As you can see the General Ledger uses the same columns as the Accounts Payable and Accounts Receivable Subsidiary Ledgers. The balance of these accounts will increase and decrease depending on the nature of the account. Accounts that are Credit in nature will increase with a Credit and decrease with a debit, accounts that are Debit in nature will increase with a Debit and decrease with a Credit.

Information contained in the General Ledger is posted from the 7 journals previously discussed and is used to create various Finance Statements and Reports that the business needs to conduct its operations and remain in compliance with its statutory obligations.

Please note: This article is presented from a theoretical perspective only and does not replace the advice of qualified Bookkeepers, Registered BAS Agents or Registered Tax Agents.